Generating random correlated data

Summary

When carrying out financial modeling we are often interested in the range of potential outcomes. Simulations can be used to assess the distribution of possible outcomes, by treating certain inputs into our model as random. If the simulations involve more than one input, and these inputs are correlated in ‘real life’, then we need to ensure that our simulated data also reflect this correlation. This post shows how correlated random data can be produced in R and Excel for this purpose.

Intro

When producing financial models, simulations are often used to assess the range of potential outcomes. ‘Monte Carlo’ analysis involves running the model a large number of times using randomly generated data. The results of the separate trials are then combined to assess the probability of a given outcome.

If your model is based two or more variables that are correlated in real life then it is important that your simulated data be similarly correlated. This blog post aims to do the following:

- Demonstrate the importance of reflecting correlations in our simulated data;

- Identify the code that can be used to generate random correlated data, using R; and

- Briefly explains how to simulate correlated data in Microsoft Excel

Example

Assume an investor is considering buying a mixed-use property near the central business district (CBD). The property has three units. The top two floors are apartments (unit A and unit B) and the ground floor is a retail space (unit C). Each of these units currently has a rent of $2,000 per month.

The investor would like to estimate the rental income generated by the building in 5 years’ time. Among other things, this would affect the price at which they could re-sell the property. The expected rental income after five years can be expressed using a simple model:

\[ income = 2000(1 +growth_A)^5 + 2000(1 +growth_B)^5 + 2000(1 +growth_C)^5 \]

where \(growth_A\), \(growth_B\) and \(growth_c\) are the average annual growth rates for units A, B and C, respectively.

The investor assumes that the market rent for each unit would grow at 2% per year. However, this is subject to risk: the actual growth rates may be higher or lower than 2%. The investor may assume that the average growth rate will follow a normal (i.e. bell-shaped) distribution, with a standard deviation of 1%.

The investor believes that the growth rates are correlated. The change in market rents for units A and B are likely to be highly correlated, given that they are both residential units sharing the same physical location. Growth in apartment rent is also likely to be correlated with rent for the retail space, but to a lesser extent.

To assess the likely range of rental incomes in five years’ time, the investor could use simulations. Simulations involve generating thousands of random data points from an assumed distribution (in this case, a normal distribution with a mean of 2% and a standard deviation of 1%). They would then plug this data into their model and observe the range of results; in this case, the potential range of income from the building.

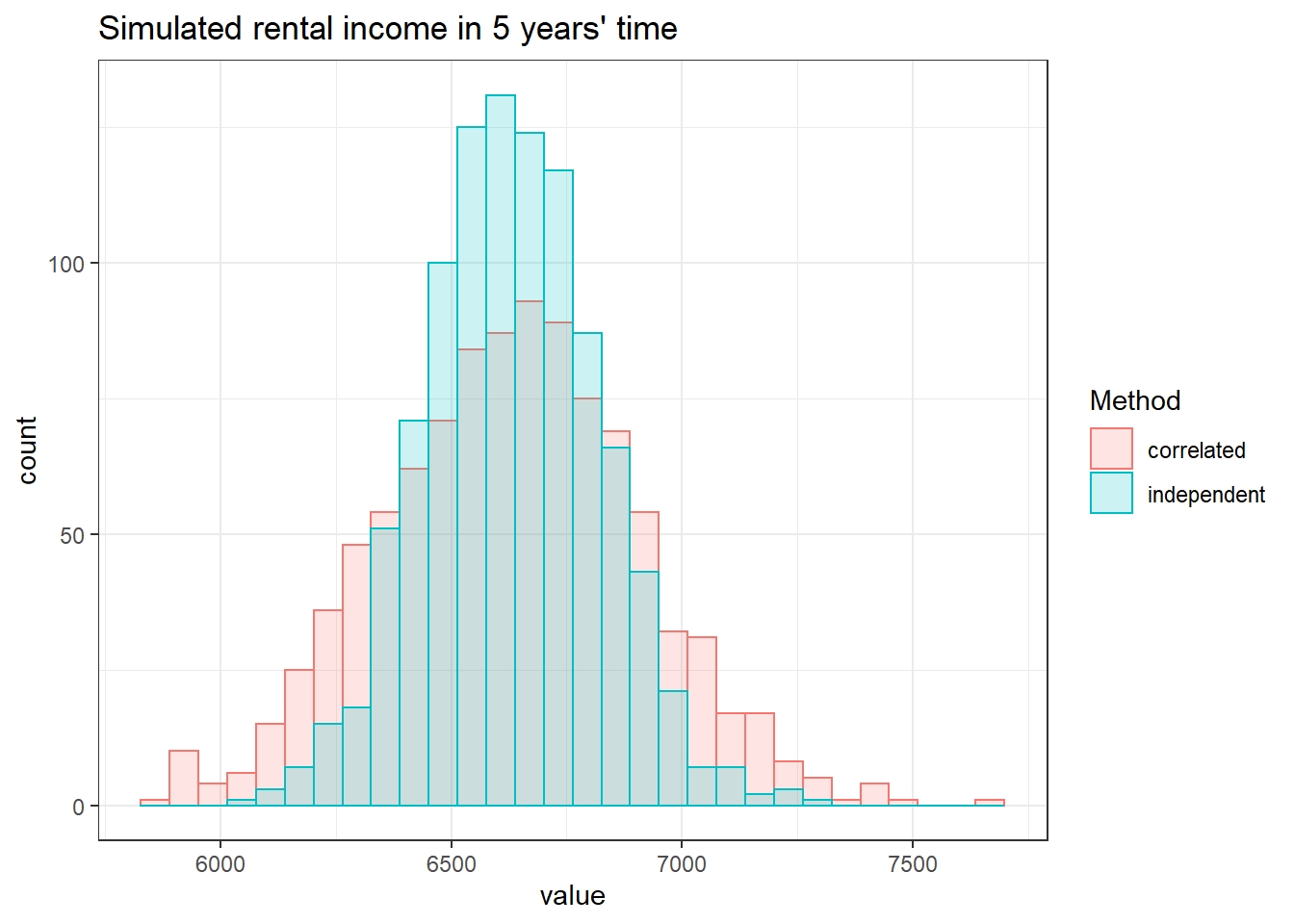

The range of the simulated outcomes will depend on whether or not correlations are taken into account. In this example, failing to reflect the correlations between unit types will underestimate the potential range of property income in five years’ time. This could lead the investor to underestimate the risk of purchasing the property.

Code to generate random simulated data

This section describes the code (using R) that can be used to generate our simulated growth rates. You can skip to the next section if you are more interested in the general principles than the nuts and bolts.

Our goal is to generate three growth rates that are normally distributed, each with a specified mean and standard deviation, and which are correlated with one another. To do this we will be using the mvrnorm function from the MASS package.

Start by loading our libraries:

library(tidyverse)

library(MASS) # to produce multivariate correlated variablesThe first step is to specify the mean growth rate for each unit (2%) and the standard deviation (1%). We also specify the correlations between the property units. We will assume the correlation between apartments (units A and B) is 0.9, while the correlation between each apartment and the retail unit (unit C) is 0.45.1 These are specified as follows:

## means of individual distributions

mu_A <- 0.02

mu_B <- 0.02

mu_C <- 0.02

## standard deviations

sd_A <- 0.01

sd_B <- 0.01

sd_C <- 0.01

## correlations

cor_AB <- 0.90

cor_AC <- 0.45

cor_BC <- 0.45The next step is to generate our simulated growth rates. We will use 1,000 trials in our simulation; each trial consists of three rental growth rates corresponding to the three building units.

First we generate the data for our trials assuming the growth rates are correlated. A key piece of information here is the covariance matrix that is specified in the mvrnorm function. For this we need the variance of each unit’s growth rate, and its covariance with other units’ growth:

# Variance

# (= standard deviation squared)

var_A <- sd_A^2

var_B <- sd_B^2

var_C <- sd_C^2

# Covariance

# (= correlation between variables * product of their std devs)

cov_AB <- cor_AB * sd_A * sd_B

cov_AC <- cor_AC * sd_A * sd_C

cov_BC <- cor_BC * sd_B * sd_C

# Set seed so that our 'random' numbers are reproducible

set.seed(1)

# Generate normally distributed, correlated random variables

growth_cor <- mvrnorm(

n = 1000,

mu = c(mu_A, mu_B, mu_C),

Sigma = matrix(c(var_A, cov_AB, cov_AC,

cov_AB, var_B, cov_BC,

cov_AC, cov_BC, var_C),

ncol = 3, byrow = TRUE),

empirical = TRUE)

# Final dataframe

growth_cor <- growth_cor %>%

as.data.frame()

names(growth_cor) <- c('growthA','growthB','growthC')Second, for comparison, we will generate the same data as though the growth rates were uncorrelated or independent. This is the same as above, but we set the covariance between the variables to zero.

# Generate normally distributed, independent random variables

growth_ind <- mvrnorm(

n = 1000,

mu = c(mu_A, mu_B, mu_C),

Sigma = matrix(c(var_A, 0, 0,

0, var_B, 0,

0, 0, var_C),

ncol = 3, byrow = TRUE),

empirical = TRUE)

# Final dataframe

growth_ind <- growth_ind %>%

as.data.frame()

names(growth_ind) <- c('growthA','growthB','growthC')Examining the simulated data

We have now generated two sets of (simulated) rental growth data for the three units in the building. The first set assumes that the growth rates are correlated, while the second set assumes that they are independent.

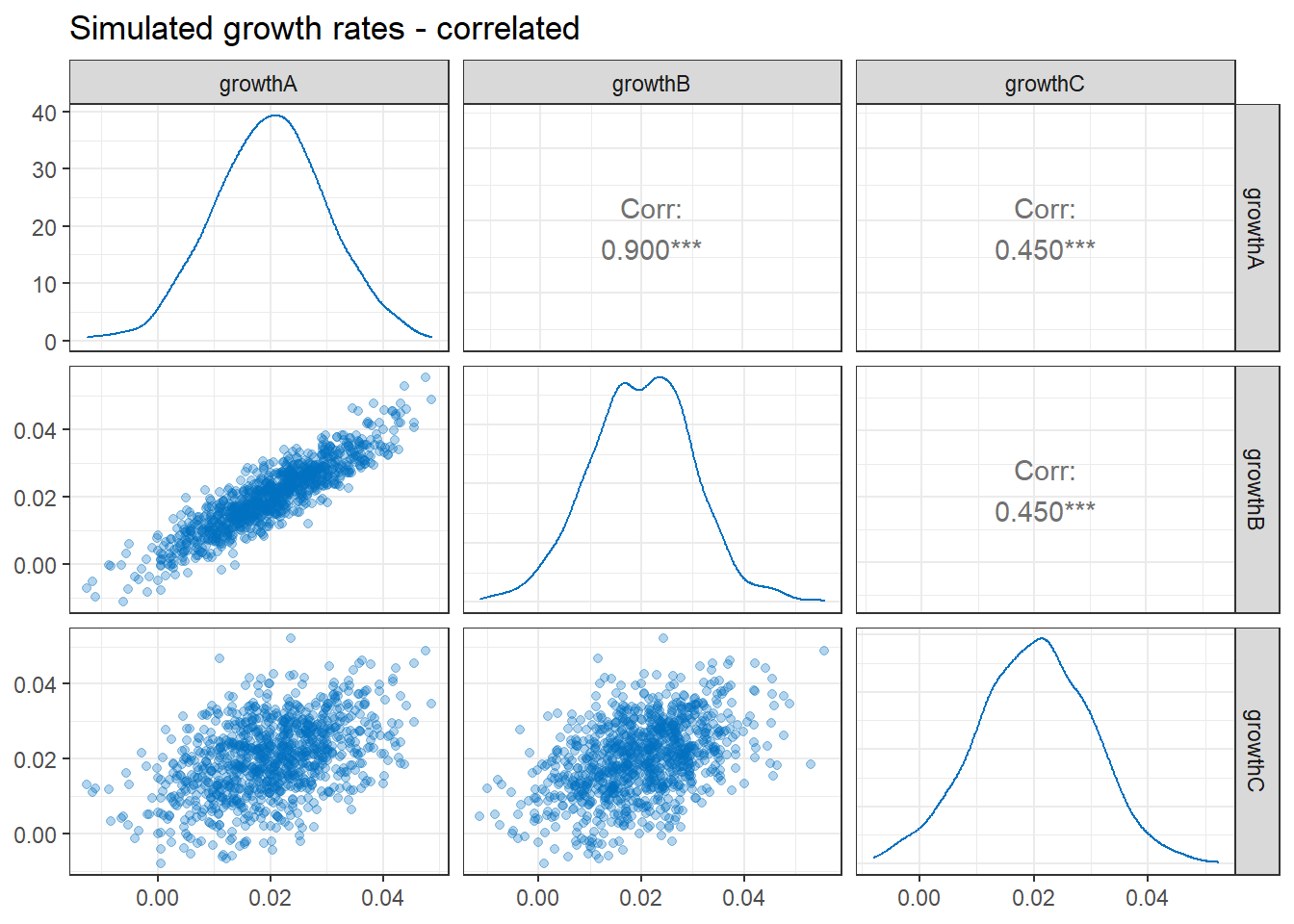

The diagram below illustrates our correlated growth rates. The 1,000 simulated growth rates are shown in the scatter plots on the bottom left. We can see that there is a high level of correlation between the growth rates for the residential units (\(growthA\) and \(growthB\)). There is also a positive correlation between these rates and rental growth for the retail unit (\(growthC\)), though the correlations are not as strong. The plots in the diagonal sections show that the distribution of the three growth rates are approximately normal.

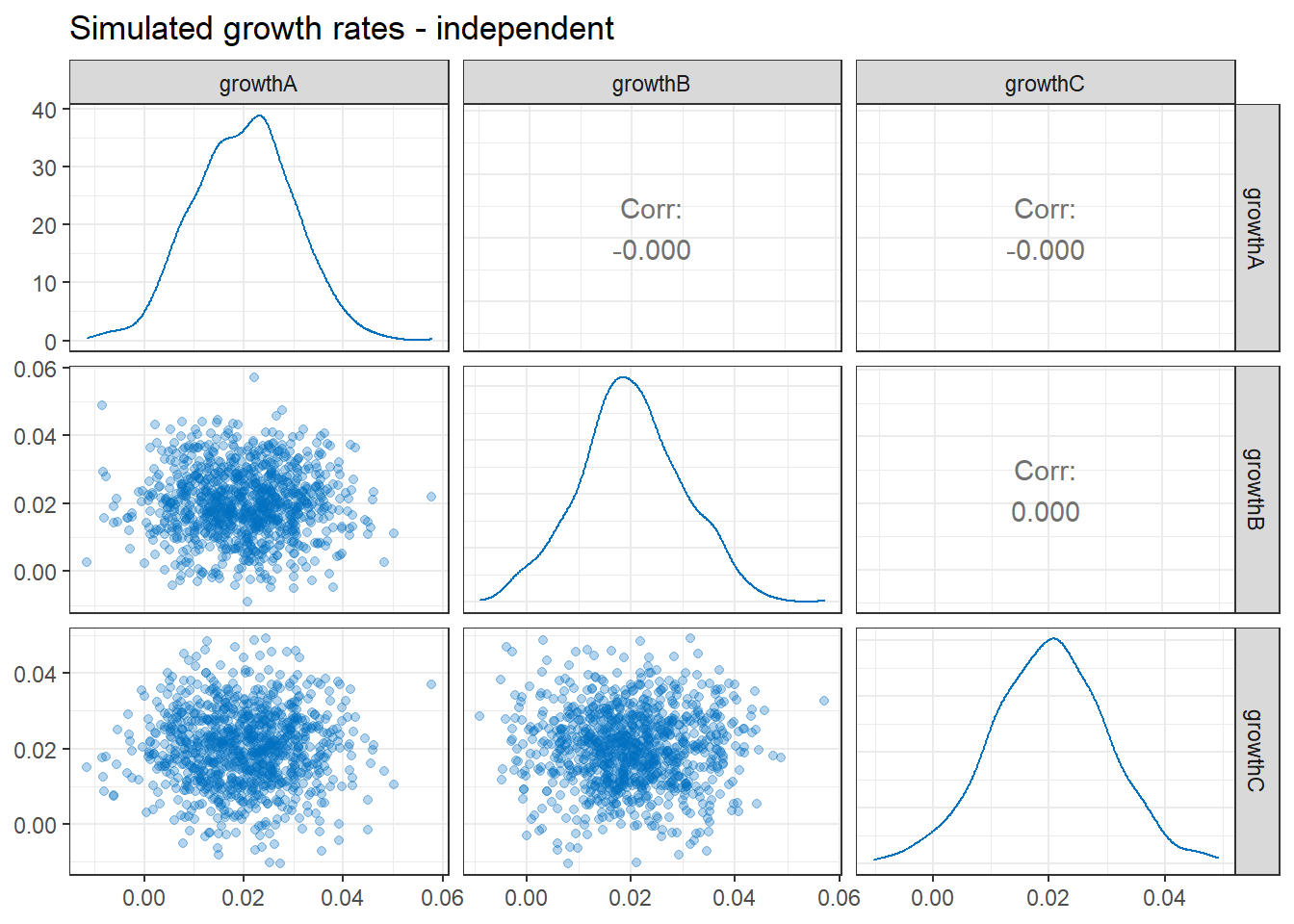

The same charts are shown for our independent growth rates, below. Note that the variables are still normally distributed, but the scatter plots show no discernible correlation.

While it is not shown here, we can confirm that the mean and standard deviation of the growth rates are exactly the same in both sets of simulations above.